How to comprehensively calculate the production cost of PP hollow board equipment

DATE:2024/9/5 14:22:15 / READ: / SOURCE:This station

Calculating the production cost of PP hollow board equipment is a very complex process that requires comprehensive consideration of multiple factors, such as the most direct production cost and fixed cost, as well as indirect and variable costs. The following are several factors and calculation methods for comprehensively calculating the cost of PP hollow board equipment.

1. Raw material cost

1. Raw material cost

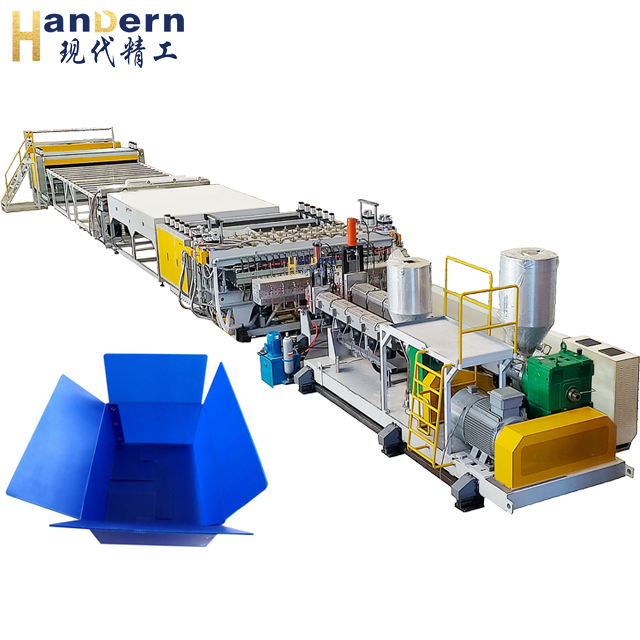

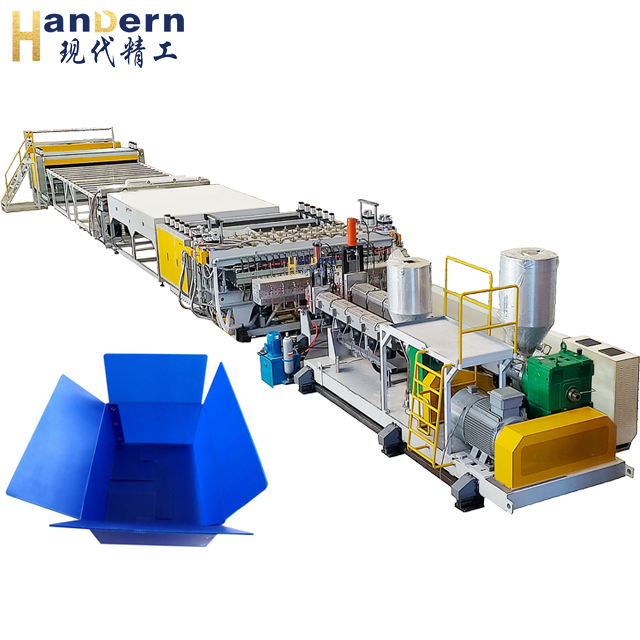

The cost of raw materials is the main component of producing PP hollow boards. The commonly used raw materials include polypropylene (PP) particles and other auxiliary materials such as additives, UV resistant agents, etc. When calculating raw material costs, the following points need to be considered:

Raw material procurement cost: calculated based on the actual quantity and unit price purchased.

Transportation cost: The cost of transporting raw materials from the supplier to the production site.

Inventory cost: The expenses incurred for storing raw materials, including the cost of renting warehouses, insurance, capital occupation, etc.

2. Equipment depreciation

Equipment depreciation is an essential part of calculating production costs that cannot be ignored. Usually, the straight-line method or accelerated depreciation method is used to estimate the depreciation cost of equipment. The calculation formula for depreciation expenses is: depreciation expenses=initial cost of equipment ÷ expected service life. When calculating, adjustments should be made based on the actual service life and residual value of the equipment.

3. Labor costs

3. Labor costs

The labor cost includes the salaries of workers directly involved in production, management personnel, and related welfare expenses. The following factors need to be considered:

Employee salary: Calculate the monthly or hourly salary of all production and management personnel.

Social insurance and welfare: social insurance and welfare expenses paid to employees in accordance with laws, regulations, and company policies.

4. Energy and water resource consumption

The energy (such as electricity, natural gas) and water resources consumed in production are important cost components. The following needs to be evaluated:

Electricity consumption: Estimate the cost of electricity based on the power of the equipment and the operating time of the production line.

Water resource consumption: such as the amount of water and cost required for equipment cooling or cleaning.

5. Maintenance and repair costs

5. Maintenance and repair costs

The equipment requires regular maintenance and upkeep during the production process, which is also a part of the production cost. include:

Regular maintenance costs: such as equipment maintenance, repair, and other expenses.

Replacement cost of vulnerable parts, such as screws, molds, etc.

6. Production management and indirect costs

The indirect costs of production management also need to be included in the cost calculation. Mainly includes:

Management expenses: such as expenses for production management personnel, office rent, etc.

Maintenance and Insurance: The cost of equipment maintenance and insurance.

7. Quality control costs

7. Quality control costs

To ensure product quality, it may be necessary to invest in certain quality control costs, including:

Testing equipment and consumables: equipment used for product testing and required testing consumables.

Salary of quality inspection personnel: the cost of personnel responsible for quality inspection.

8. Marketing and sales costs

Although this part is not directly related to production, the marketing costs of entering the market should also be considered, including advertising expenses, sales personnel salaries, and market research expenses.

Comprehensive calculation

Comprehensive calculation

Summarize all the above cost categories to obtain the total production cost of PP hollow board: total production cost=raw material cost+equipment depreciation+labor cost+energy cost+maintenance cost+indirect cost+quality control cost+marketing cost

The cost of raw materials is the main component of producing PP hollow boards. The commonly used raw materials include polypropylene (PP) particles and other auxiliary materials such as additives, UV resistant agents, etc. When calculating raw material costs, the following points need to be considered:

Raw material procurement cost: calculated based on the actual quantity and unit price purchased.

Transportation cost: The cost of transporting raw materials from the supplier to the production site.

Inventory cost: The expenses incurred for storing raw materials, including the cost of renting warehouses, insurance, capital occupation, etc.

2. Equipment depreciation

Equipment depreciation is an essential part of calculating production costs that cannot be ignored. Usually, the straight-line method or accelerated depreciation method is used to estimate the depreciation cost of equipment. The calculation formula for depreciation expenses is: depreciation expenses=initial cost of equipment ÷ expected service life. When calculating, adjustments should be made based on the actual service life and residual value of the equipment.

The labor cost includes the salaries of workers directly involved in production, management personnel, and related welfare expenses. The following factors need to be considered:

Employee salary: Calculate the monthly or hourly salary of all production and management personnel.

Social insurance and welfare: social insurance and welfare expenses paid to employees in accordance with laws, regulations, and company policies.

4. Energy and water resource consumption

The energy (such as electricity, natural gas) and water resources consumed in production are important cost components. The following needs to be evaluated:

Electricity consumption: Estimate the cost of electricity based on the power of the equipment and the operating time of the production line.

Water resource consumption: such as the amount of water and cost required for equipment cooling or cleaning.

The equipment requires regular maintenance and upkeep during the production process, which is also a part of the production cost. include:

Regular maintenance costs: such as equipment maintenance, repair, and other expenses.

Replacement cost of vulnerable parts, such as screws, molds, etc.

6. Production management and indirect costs

The indirect costs of production management also need to be included in the cost calculation. Mainly includes:

Management expenses: such as expenses for production management personnel, office rent, etc.

Maintenance and Insurance: The cost of equipment maintenance and insurance.

To ensure product quality, it may be necessary to invest in certain quality control costs, including:

Testing equipment and consumables: equipment used for product testing and required testing consumables.

Salary of quality inspection personnel: the cost of personnel responsible for quality inspection.

8. Marketing and sales costs

Although this part is not directly related to production, the marketing costs of entering the market should also be considered, including advertising expenses, sales personnel salaries, and market research expenses.

Summarize all the above cost categories to obtain the total production cost of PP hollow board: total production cost=raw material cost+equipment depreciation+labor cost+energy cost+maintenance cost+indirect cost+quality control cost+marketing cost

Author:admin